QDLP试点制度简介

2021.05.14 谢青 秦天宇

自2012年上海率先开展合格境内有限合伙人(简称“QDLP”)试点以来,QDLP试点已经实施并经历了近10年的发展。截至目前,已经有上海、北京、青岛、海南、广州、苏州等城市先后获得了QDLP试点额度并陆续展开了QDLP试点。上海作为最早开始QDLP试点的城市,其QDLP试点机制最为成熟并已率先实现QDLP试点常态化。

一、QDII、QDLP与QDIE制度比较

合格境内机构投资者(Qualified Domestic Institutional Investor, 简称“QDII”)、合格境内有限合伙人(QDLP)和合格境内投资企业(Qualified Domestic Investment Enterprise, 简称“QDIE”)制度均使得具有相关资质的机构可以在中国境内募集资金并投资于境外市场,是境内机构、高净值人群海外资产配置的主要渠道之一。

QDII机制建立于2006年,旨在允许境内金融机构(包括商业银行、信托公司、证券公司、公募基金管理公司和保险公司)投资于境外市场。境内金融机构应向其各自的监管部门申请QDII资质与额度,且不同金融机构发行的QDII产品的投资范围受限于其各自监管部门的相关规定。

QDLP和QDIE试点机制为QDII机制的补充。QDLP机制设立之初旨在允许符合条件的境外机构在有QDLP试点额度的城市申请QDLP资质,发起设立QDLP基金投资于境外市场,后部分城市允许境内符合条件的私募基金管理人申请QDLP资质。实践中,QDLP基金多为联接基金,其主要投资标的为境外申请机构或其关联方所管理的海外基金(即QDLP基金的主基金),通过海外基金间接投资于境外底层资产,在QDLP基金层面不进行主动管理。也即,QDLP基金主要为境外申请机构或其关联方的海外基金提供一个在中国境内的募资渠道。目前,部分试点城市已经在探索发行主动管理型QDLP基金的可行性,即允许QDLP基金直接投资于境外底层资产。

QDIE试点目前仅在深圳展开。实践中,与QDLP不同,QDIE主要为境内金融机构和私募基金管理人开展境外一级市场投资提供投资渠道,不鼓励QDIE基金投资境外二级市场。2021年4月30日,深圳发布了《深圳市开展合格境内投资者境外投资试点工作管理办法》(简称“QDIE新规”),对QDIE机制作出了修订。QDIE新规规定,QDIE管理人可由外国投资者参与设立,分为外资QDIE管理人和内资QDIE管理人。同时,QDIE新规扩大了QDIE基金的投资范围,除境外一级市场投资外,QDIE新规明确允许投资境外债权、境外上市公司非公开发行和交易的股票和债券、境外私募股权投资基金和私募证券投资基金等。

实践中,QDII额度和QDLP额度被授予获得相应资质的机构,QDII机构和QDLP机构可自行决定QDLP额度在其管理的产品中的分配;而QDIE额度被授予具体项目,QDIE新规亦允许根据需要变更拟投资项目。

二、主要试点城市QDLP试点政策比较

以下我们主要比较了上海、北京、青岛、海南的QDLP试点政策。

1、 典型QDLP试点架构

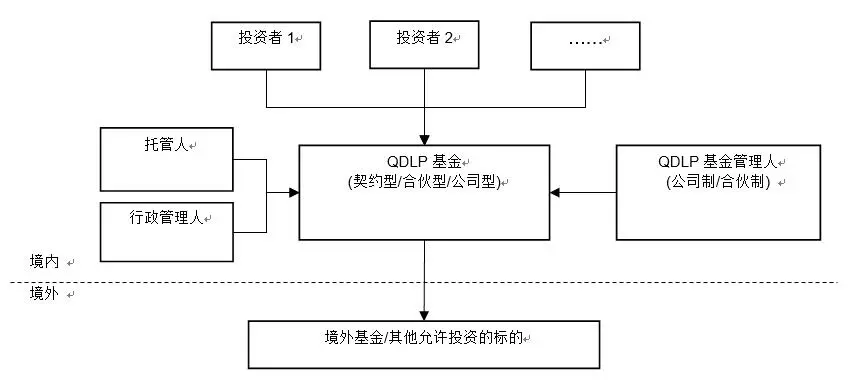

各QDLP试点城市QDLP基本架构一致,如下图所示:

注:实践中,QDLP基金托管人和行政管理人可以为同一机构。

参与QDLP试点资质的境外机构需要在中国境内设立一个QDLP基金管理人,QDLP基金管理人在中国证券投资基金业协会(简称“基金业协会”)登记为其他类私募基金管理人后,方可发起设立QDLP基金。实践中,QDLP基金管理人多为公司制,QDLP基金多为契约型。

2、股东资质

四个试点城市均对QDLP基金管理人的实际控制人、控股股东或执行事务合伙人提出了要求。其中,青岛的QDLP资质申请主体必须为境外机构,北京和海南允许已经成功发行至少一只私募基金并符合一定合规要求的境内私募基金管理人申请QDLP试点资质。

四个城市均要求境外申请机构的实际控制人、控股股东和/或控股股东的关联方有一定的投资管理经验和/或金融牌照,同时对其经营状况、治理结构、内控制度以及合规性等作出了规定。其中,北京明确要求QDLP基金管理人的控股股东、实际控制人或执行事务合伙人为金融机构或资产管理规模不低于1亿元人民币或等值外币。此外,北京和海南对净资产亦作出了明确的要求。

由于该等要求并非针对QDLP基金管理人的直接股东,这意味着境外机构仍可以根据自身集团发展规划、税务考量等选择合适的主体作为QDLP基金管理人的直接股东。

3、注册资本

除青岛外,其他三个城市都对QDLP基金管理人的注册资本提出了要求。其中上海为200万美金(约1300万人民币),北京为3000万人民币或等值外币,海南为500万人民币或等值外币。

4、高管/投资管理人员要求

就高管人数而言,上海要求至少有2名高管人员,即1名法定代表人或执行事务合伙人(委派代表),1名合规负责人;青岛仅要求1名高管,上海和青岛对该等人员的投资管理经验、高管经验和合规均分别作出了要求。北京和海南则要求至少1名符合要求的投资管理人员。上海和青岛进一步要求至少1名高管人员常驻在本市。

需要注意的是,由于QDLP基金管理人必须在基金业协会登记为私募基金管理人,因此,QDLP基金管理人为满足登记要求,必须有5名全职员工。实践中,在上海申请QDLP资质的境外机构,如果该QDLP基金管理人为该外资机构在境内独资设立的私募证券投资基金管理人(简称“WFOE PFM”)的全资子公司(简称“QDLP SPV”),则对该QDLP SPV的注册资本、注册地址和人员不另作要求,QDLP SPV的注册资本可为200万人民币,可以与WFOE PFM共享员工和注册地址。

5、QDLP基金

(1) 投资范围

四个城市QDLP基金的投资范围如下所示:

上海 | 境外市场投资 |

北京 | 境外证券市场;境外大宗商品、贵金属、对冲基金、REITS、金融衍生品等标的资产;投资其他证券投资基金、发起设立境外证券投资子基金;境外债券、证券基金份额;未上市企业、私募股权投资基金等非公开市场领域 |

海南 | 境外非上市企业的股权和债券;境外上市企业非公开发行和交易的股票和债券;境外证券市场(包括境外证券市场交易的金融工具等);境外股权投资基金和证券投资基金;境外大宗商品、金融衍生品 |

青岛 | 主营业务境外二级市场,探索一级市场投资并购业务和有监管的大宗商品交易市场 |

实践中,上海的QDLP基金主要通过投资于QDLP基金管理人海外关联方所管理的海外基金最终投资于底层资产,但对底层资产类别没有限制。目前,上海正在探索允许QDLP基金采取主动管理的模式直接投资于境外股票、债券等投资标的。

(2) 初始募集规模

除青岛外,上海、北京、海南均对QDLP基金规模作出了要求。北京为1亿元人民币或等值外币;海南为3000万人民币或等值外币;上海合伙制QDLP基金最低初始募集规模为1亿元人民币,契约型QDLP基金的最低初始募集规模为3000万人民币。

三、QDLP申请流程(以上海、北京为例)

各地QDLP的申请流程大同小异,均为向当地相关审核机构提交申请文件,通过审批后获得QDLP资质。以下以上海和北京为例介绍QDLP试点资质申请流程。

1、上海QDLP申请流程

No. | 步骤 | 备注 | |

1. | 提交试点申请 | 向联席会议提交试点申请文件 | |

2. | 联席会议评审 | 联席会议对申请材料进行评审,并出具意见。 提示:疫情期间,联席会议改为线上召开,无需申请人现场参加。 | 通过联席会议的申请主体,上海金融局会直接向上海市市场监督管理局(“市工商”)出具一份支持函件,请其协调办理公司设立的相关注册登记手续。 |

3. | QDLP基金管理人设立/QDLP基金设立(如需) | 1) 向市工商局申请名称预核准 2) 完成注册登记(市工商)如QDLP基金是以有限合伙企业形式设立的,则须在QDLP基金管理人成立后设立QDLP基金主体。 | 从名称预核准至拿到营业执照一般需要1个月(不包含银行账户开立),银行开户需要1个月的时间。 |

4. | 申请QDLP试点资格及额度 (拿到营业执照后即可申请) | 拿到营业执照后,需向联席会议申请试点资格及额度;上海金融局发出批复函,函告试点管理企业获得试点资格及相关额度。 | 1) 获得试点资格及额度不以办理完AMAC登记为前置条件。 2) 获得试点资格后6个月内需要完成海外投资基金的募集和设立工作。 |

5. | 办理外汇登记手续 | 取得联席会议批复函后至外汇局上海市分局办理外汇登记等手续。 | 托管行会协助办理外汇登记,具体材料以托管行届时要求的为准。 |

2、北京QDLP申请流程

No. | 步骤 | 备注 | |

1. | 提交试点申请 | 向联审工作办公室提交试点申请文件 | |

2. | 联席会议评审 | 联审办工作办公室决定受理申请机构的试点申请,征求试点联审成员单位意见,并组织召开试点联审工作会议,联合审核试点申请材料。 | 经审核符合试点要求的,报市政府同意后,由试点工作联审办公室向申请人出具同意开展、给与试点额度的书面意见 |

3. | QDLP基金管理人设立/QDLP基金设立(如需) | 1) 向市工商局申请名称预核准 2) 完成注册登记(市工商) 完成注册登记后须进行私募基金管理人登记 | 从名称预核准至拿到营业执照一般需要1个月(不包含银行账户开立),银行开户需要1个月的时间。 |

5. | 办理外汇登记手续 | 凭借书面意见至外汇管理部门办理外汇登记并至托管行开立相关账户 | 托管行会协助办理外汇登记,具体材料以托管行届时要求的为准。 |

四、我们的服务

1、 QDLP资质申请

协助申请机构设计QDLP架构(例如,试点地区、申请机构选择、人员安排、税务考量等);

协助申请机构准备QDLP资质申请全套文件;

协助申请机构与对应监管部门进行沟通;

2、 QDLP基金管理人设立

协助申请机构准备QDLP基金管理人公司注册全套文件;

协助申请机构完成公司设立;

提供其他诸如税务、劳动、网络安全、数据合规等全方位的法律咨询服务;

3、 私募基金管理人登记

为私募基金管理人登记之目的进行尽职调查并出具法律意见书;

Ambers系统填写指导;

就任何与私募基金管理人登记相关的问题提供法律咨询;

4、 QDLP基金发行

协助申请机构选择托管行、行政管理人等机构;

协助申请机构起草全套QDLP基金相关文件(例如基金合同、外包协议、代销协议等);

就任何与QDLP基金发行相关问题提供法律咨询;

5、 QDLP基金管理人和QDLP基金持续运作

就QDLP基金管理人和QDLP基金运作过程中产生的问题提供法律咨询。